Investing Follow-up: FAQs

The content of my investing post is far from original. If you know about index funds, this is old news. My hope is that through that article a few readers came away with a better understanding of investing (and index funds). If that’s true, you’ve probably got some questions.

1 or 2% fee - what's the big deal?

1% sounds small. But in the world of investing, the results are MASSIVE - particularly over time.

For instance, just a 1% fee on a 10,000/year investment over 40 years would lose $600,000 in value. You read that right.

If you're paying a one percent fee you are making a half-million dollar donation to the richest people on the planet.

In a world where fund managers don't matter, the FEE is the thing you need to pay attention to.

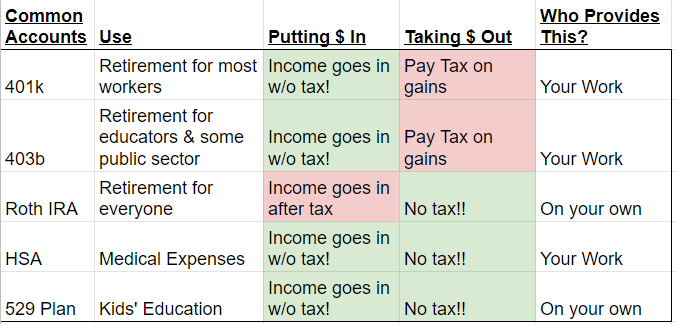

What do I mean by a tax-advantaged account?

If you think 1 or 2% fees can wreak havoc on investment gains, imagine what 15 or 20% taxes can do. Thankfully there's a number of ways to significantly soften the blow in the US.

But what about my nephew who made $100,000 on ____ stock?

People make it big all the time on individual stocks. People lose their shirt all the time on individual stocks. That ones who make it big make the papers (or just tell everyone). The ones who lose everything don't.

Buying individual stocks can be fun, but should be treated a bit like going to the casino. Your odds are actually much better than the casino depending on the stock- but because you don't know the future - and stock prices are subject to all the emotions and irrationality of humans - they can fluctuate wildly and trying to predict this over time is futile.

The biggest benefit of a basic index fund is that your mind is now freed up from thinking about what to invest in, analyzing companies, etc. to focus on making lifestyle changes so you can contribute more (picking up biking for instance).

What about crypto?

I actually know someone who is up $100,000 in a month on a $10,000 crypto purchase. I’m not going to try and replicate it and neither should you.

For cryptocurrencies, take all of the irrationality and craziness and price fluctuations around an asset like stocks. Now take away the underlying asset that has real value and keep all the gambling and weird psychology (with a heavy dose of FOMO) around them. Boom. You've got cryptocurrency.

Remember that stocks have real inherent value - that Ford stock means you really own factories and intellectual property and everything that Ford owns. With crypto, there is no inherent value.

While blockchain is an intriguing technology that may or may not play a role in the 21st century, crypto currencies are something different altogether.

By definition they are not an asset. They don't produce anything over time - and they don't try to.

Unfortunately, they're not even currency. Until a crypto currency is a store of value, unit of account, and medium of exchange (the marks of "money") it is nothing more than a fascinating zero-sum experiment in human psychology, FOMO, and Greater Fools. Like with any speculative game, many will make money and any will lose money. Of course, feel free to play the game as much as you want with money you could comfortably lose.

Just don’t call it investing!

What about Warren Buffett?

I love Warren Buffett’s story. He is one of the few people who has beaten the market over his career and also he’s just an interesting person. Does that mean I should try and imitate him?

Probably not.

First off, he’s brilliant.

Second, he’s spent his entire life reading over financial documents - since he was about ten years old reading over financial statements. It’s his favorite hobby.

Third, how did he make his money? 99.99% of the time, the rules of the index funds are all you need to crush other funds. Every once in a great while, though, there are times when a very smart, cool-headed, cash-heavy independent thinker can outperform. Generally it’s in a crash.

Warren Buffett’s made a number of good investments over the years (though he’s been crushed by the index over the last fifteen years). But his best investing moments were stepping into what appeared to be a burning building and buying shares in that building for dirt cheap as people ran out screaming.

Fourth, the most underrated aspect of his success is his longevity (he’s invested in stocks from age 10 to 90, with 90+% of his net worth coming after age 70).

Fifth, here’s what he recommends to people (including his wife for after he dies) about making money in the stock market:

“I recommend the S&P 500 index fund”

Warren Buffett

I already know this stuff. Anything more advanced?

Sure. If you want extra credit (by that, I mean extra money), there are some advanced stuff you can learn about. Note that the advanced stuff isn’t about stock picking - it’s about lifestyle design and tax minimization:

Design Life to Maximize Contributions

If you’re able to bump up your savings rate beyond the 15% you can retire earlier- much earlier. In fact “years left working” is simply a function of one variable that’s in your control: your savings rate.

Ride a bike: After housing, transporation is the second biggest budget item for Americans. Luckily, you can reduce or eliminate it completely through biking.

The best resource on designing an efficient life is Mr. Money Mustache. It is truly the PhD in personal finance and what is possible for those who can live a bit more simply.

Avoid taxes altogether:

Roth Conversion Ladder: You can combine the power of your 401k and your Roth IRA to pay no tax going in AND no tax going out. It's called a "Roth Conversion Ladder" and while it's been in effect for decades, it's currently on the chopping block as a loophole Biden wants to close.

HSA: The Ultimate Retirement Account: Log your HSA expenses right away - but don't reimburse yourself until you need the money (preferably after retirement). Result: Tax free contributions, tax free growth, tax free withdrawals. Crazy.

Small-Cap Allocation: While the principle of index rules are more or less perfect, what’s not yet perfect is the weighting of the stocks in that index. VTI weights by market cap (the bigger the company, the more VTI has of that company). This means that most of what you buy in VTI is Apple, Amazon, and the other huge tech companies. By shifting the weighting towards smaller companies (but still using Vanguard index funds), there’s a good chance that you could outperform VTI in the long run.

Buy a Rental Property: If you’re willing to take on a bit of hassle, you can get returns that can crush Warren Buffett. And you might become a better person in the process (see link).

Retire in your 30s: That’s right. Most middle-class Americans can retire in their 30s if they're willing to put their extra money towards freedom instead of stuff. There’s a whole movement behind it.

What questions did you have around index funds or investing?