It’s Time for a Raise

It’s time to get back on the wagon with our finances.

To be clear, we haven’t been complete money slobs since we had kids. Yet, almost as a rule, we’ve consistently passed over rental properties in favor of minivans and traded maximum mutual funds for modern-day time luxuries like raising our kids at home. And you know what? I wouldn’t trade it.

These days, though, with kids about to head off to elementary school it’s time to play financial catch-up.

Enter the deceptively powerful side hustle. Let me illustrate its power with an example.

Fictional Frank’s Favorite Function

Fictional Frank is making $50,000/year with a savings rate of 20%. In other words, Frank is putting away $10,000 per year towards his long term goals. Not bad.

However, let’s say Frank picks up a side hustle selling homemade mugs, netting himself another $10,000/year. This amount might seem unimportant compared to his $50k salary.

He might ask, “Is all that mug-making work worth it for a mere 10k? Will it actually move the needle?

Enthusiastically, I say “Yes!”

Hidden beneath Frank’s humble $10k/yr side hustle is the fact that Frank has just doubled his savings rate. Translation: wherever he’s going with his goals (retirement, lake cabin, South of France, etc.) Frank will cut his time to reach his goal in half with this small side hustle.

(Bonus: If he can add another 10k/yr he has now tripled his savings rate. He’s cut his savings time by 2/3. Invest the proceeds and the effect is even more powerful.)

Even better, this new income exists outside of his 9-5 gig. Unlike a bonus or raise, this new 10k/year is not at the mercy of his company’s revenue, his relationship with his manager, or some recession which may or may not come.

“Fine” I can hear you saying, “I guess I wouldn’t mind doubling or tripling my savings rate”, I’ll just google ‘side hustles’ and take the first thing I see.

I wouldn’t do that.

One Size does not Fit All

Despite all the side hustle talk on the internet, few content creators distinguish between the sizes of side hustles and how they may or may not fit into your life.

Young and kidless? You’ve likely got bandwidth to go big (like I kinda-sorta did). Look up Brandon Turner. Alex Hormozi. Or Codie Sanchez. These are the current-day kings of the “big millionaire side hustle”. They’ll push you to add skills, put in long hours on nights and weekends, and build something that scales big and quick.

Side Hustle For the Time-Starved

For many of us, that kind of hustle isn’t possible (or desired). Do not despair. Even the most time starved among us (busy parents included) can still find a side hustle that fits without nuking your family in the process. You’ll need to be picky, though, and select only side hustles that are flexible, low-time, and low-energy. No home runs for you. Instead, you’re going to hit regular and frequent singles and it’s going to dramatically change your financial future.

Ok, enough about you - let’s talk about me :)

Here’s one busy dad’s plan to try and drum up an extra $50k or so in the coming year. Perhaps one of the ideas could work for you if you’re in a financial pinch.

Speaking of a financial pinch…

My Side Hustle Plan

1. Poop with Purpose ($14,000)

There is a literal crapload of research going on in the world of gut biota. Specifically, companies are successfully researching how to use gut biota from a healthy “#2” to heal everything from IBS to obesity(!). It’s an incredible medical advancement, but it’s one that requires tremendous amounts of doo-doo. What the crap does that mean for your finances? Ladies and gentlemen, you are currently living in the age of poo for pay.

Don’t believe me? At this moment, there are people pulling down $180,000/year as professional poopers. If you live around the twin cities, odds are you’re (literally) flushing money down the toilet every single day.

The place I donate at is Rebiotix in Roseville, MN. Their mission is focused on eliminating a difficult digestive condition called C. diff. Willing donors can expect a more purposeful poo in addition to up to $60 per day with qualifying “donations”. With the other perks ($50 for biweekly COVID tests), I’m hoping to average about $300 per week. That may not sound like much, but if I can do it, this little morning habit will net $1200/month… which amounts to $14,000/year!

Throw in a spouse and you can double it. For fun, I did the math and (incredibly), an eligible couple could make up to $46,400 dollars per year for going to the bathroom.

If you do it, please mention my name as a referral when you sign up!

2. Bank and Credit Card Bonuses ($15,000)

Free travel is great. By the end of this year, Lord-willing, I’ll have made it to Spain and Portugal, Japan, Quebec, and Italy - all for free. In addition to the free flights and hotels, I try to regularly hit lucrative bank signup bonuses for cash.

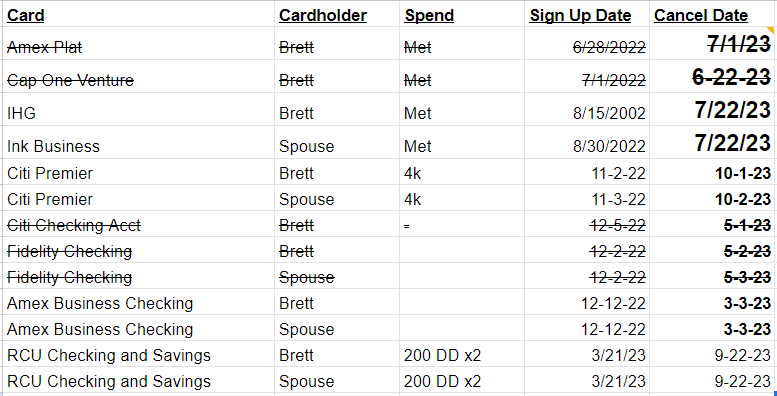

Whether it was Royal Credit Union in the spring for $600 or Amex business checking accounts last winter for $2400, making bank and credit card signups a discipline can accrue into a massive (often tax-free) financial boost.

Typical tracking spreadsheet for me

When you total the signup bonuses (and my recently opened 5% interest checking account from Wealthfront), I’ve made over $15,000 in the last year from comfort of my porch and I’ll be continuing this discipline into the fall.

Big Pink Box: If you’re interested in hearing when I’m doing a card / bank bonus, just shoot me an email (brett@brettwrites.com). I’ll try to remember and loop you in on some of the stuff that I’m up to in realtime.

3. Fire my property manager ($18,000/ year)

Less than a month into our third kid, our rental property basement was drowning in melting snow - and we were drowning in babies. So, after a near-flooded basement in 2019, we reluctantly hired our first property manager.

The good: I’ve been able to keep my properties through the most intense years of my life.

The bad: The results have varied from “acceptable” to “nauseating”

The ugly: My property managers have generally been asleep at the wheel. The one thing they have been consistent at is charging massive amounts of money and neglecting my tenants. Sure, the $90/unit fee sounds amazing… but the reality is that the costs (placement and renewal fees, vacancies, turnover, and on and on) may eventually run your business into the ground.

I’m banking that even a half-ass job from myself, or honestly, even a “1/10 ass job” when I’m on the other side of the planet, can provide my tenants with a much smoother experience- and save me $15k-$20k/year in the process.

4. Etc

Pre-school is finally ending for us! ($6k/year savings). My wife is going to sub part time in the fall! ($10-20k/year?) And who knows what else will come up in this crazy land of opportunity we call America?

Let’s goooooo!

Conclusion

We all want a raise, don’t we? If you’re like me, though, you’d rather not wait around for an employer who may or may not come through with an end-of-the-year money shower. With recession clouds looming, I’m taking matters into my own hands.

What about you? Would you consider a side hustle if it meant reaching your goals in half the time (or less)? If so, what’s your side gig?!