Die With Zero

A Review

“Most of us go through life as if we had all the time in the world. It makes sense to delay gratification to some extent, because that pays off in the long run. But the sad truth is that too many people delay gratification for too long, or indefinitely. They put off what they want to do until it’s too late, saving money for experiences they will never enjoy.” - Bill Perkins, Die with Zero

When I was 23, Dave Ramsey’s “Ben and Arthur” chart changed my life.

The chart tells the story of two fictional investors, Ben and Arthur. Ben invests young, Arthur invests later, Ben’s investments crush Arthur’s.

Ramsey’s point: Deferring is the key to a rich life.

Dave isn’t wrong. If historic returns hold, every $1 you invest at age 20, will be worth $88 at age 65.

Ramsey and the whole personal finance industry continually push us to defer.

And yet, reminds Bill Perkins, Ben forgot one hard reality as he deferred away his young, healthy years.

Your life (and health) here on earth is finite, and running down by the day.

The ramifications are many.

Here are four concepts I took away from this much-needed “anti-personal-finance” book:

Memory Dividends

This hike was tough at age 36!

Question: What’s the difference between going to Italy when you’re 20 vs. going to Italy when you’re 70 (besides the arthritic knee that keeps you from climbing the Spanish steps)?

Answer: A lifetime of recalling the memories.

My travel memories, for instance, haven’t just warmed me on cold winter days, they’ve broadened my perspective on almost everything. My time outside the US has given me a lens that I use everyday to evaluate what my life is- and can be.

“Unlike material possessions, which seem exciting at the beginning but then often depreciate quickly, experiences actually gain in value over time.” -p.13

Many Experiences Can't Be Deferred

The Ben and Arthur chart implicitly assumes that a dollar spent when you’re 65 is the same as a dollar spent when you’re 20. Perkins reminds us that this couldn’t be further from the truth.

While it may feel like we have forever to defer the things we aim for in life, the reality is that our windows of opportunity are often tragically small. Perkins illustrates this point with stories from his own life that remind us that many opportunities come but once.

Bill Story #1: The Reckless (but Rational) Roommate

Out of college, Bill’s roommate quit his job and then borrowed money from a real-life New York City loan-shark for a trip to Europe.

"I said to Jason, “Are you crazy? Borrowing money from a loan shark? You’ll get your legs broken!”

When he came back a few months later, though, there was no discernible difference between his income and mine - but the pictures and stories of his experiences showed that he was infinitely richer for having gone. I felt pretty envious- and regretful that I hadn’t gone.

When I finally went to Europe, at age 30, it was too late: I was already a tad too old and too bougie to stay in youth hostels and hang out with a bunch of 24-year-olds. Plus, by the time I was 30, I had many more responsibilities than I’d had in my early twenties, which made it that much harder to take months off for travel.

Like me, Jason knows he timed that European trip exactly right. “I wouldn’t enjoy sleeping in a youth hostel with 20 guys on a shitty bunk bed now.” Despite the high-interest loan, he has the opposite of regret about the expense. “Whatever I paid was a bargain because of the life experience I gained,”

What he gained from that trip, in other words, is priceless. - p.21 [abridged for lenth]

Bill Story #2: The 45th Birthday

For his 45th birthday, Bill spent a painful amount of money flying his friends, family, and favorite musician to an all-out “all-the-people-I-love” bash in the Caribbean. Why did he do it? Or why didn’t he at least defer until the bigger milestone of age 50 after his investments accumulated for five more years?

He writes:

By the time my 50th rolled around, my dad had died, mom’s health had, unfortunately, declined substantially. My brother and two sisters were there, but some of my friends couldn’t make it this time. From my perspective, it had been a very good decision to splurge on that extraordinary gathering five years earlier.

Or… I could have not splurged on that lavish party when I was 45. Instead I could have celebrated my birthday by just looking at my monthly investment savings and IRA statements. But what kind of memory would that be? - p.153 [abridged]

Could you and I wail til we’re 65 to go to Europe? Absolutely. But make no mistake- you are paying for a very different trip than that of Bill’s roommate.

When we went to Provence two years ago, we did it with our young family. We did it with our vibrant, healthy moms. I hope we have our whole lives to travel, but for that trip, 2022 may have been the only opportunity we get.

A Generous Life

How old are most people when they receive their inheritance? 30? 40? Nope.

The median age for Americans who receive an inheritance is 60 years old. (You know, right around the time you don’t actually need it.)

For many years after her divorce, Virginia Colin struggled financially. Receiving almost no child support from her ex, she raised her four children on her own, "mostly at the edge of poverty," as she puts it. She eventually remarried, was able to hold down a decent part-time job, and attained financial stability. Then, when she was 49, her mother died, at age 76, leaving Virginia with a large inheritance.

The $130,000 windfall was definitely welcome-no question about that. "But it just would have been a lot more valuable a lot earlier," says Virginia, who is now 68. - p.82

In other words, what would it look like to give a smaller inheritance earlier?

Furthermore, Perkins asks: who is the generous person? The person six feet under whose former possessions are distributed by lawyers? Isn’t the generous person the one who is living? Doesn’t generosity require being around to actually give?

Whether its inheritance or giving to charity, Perkins challenges what is possible and what is best in light of the “peak utility of money” for both the giver and the receiver.

Time Buckets Over Bucket Lists

What are the things you hope to do during your brief existence here on Earth? Here are a few things I would love to do:

Buy or build a cabin in the woods near Lake Superior’s north shore

Mentor young men in my neighborhood

Live in Europe

Pour everything I have into loving and discipling my kids.

The bucket list would have me lazily set these out with no timeline - as if I could pick and choose as I saw fit. Time buckets on the other hand dispel the illusion of infinite time and flexibility.

These buckets resolve the donkey problem and more importantly make it clear that many of your goals can only be achieved within a small window of your life.

Here’s those same goals, in decade bucket format:

My 30s: Pouring everything I’ve got into my kids

In thirteen years, all my kids will have left. Heck, in five years, they’ll be too cool to hang out and listen to me. The harsh reality: I’ve got a few short years to make the big memories and to put everything I’ve got into these little hatchlings- who are quietly but quickly growing wings.

My 40s: Mentoring younger men

Having left diapers behind and entered the teenage-parenting years, this may be the best time to coach sports or invest heavily into a youth group.

My 50s and beyond:

Living in Europe

A move that is super difficult right now, would likely be much easier when we no longer have to fork over $40,000/yr for international school, can be flexible visa-wise, and when all that’s needed to live is a little 1-BR overlooking the Mediterranean.

North shore cabin

In my 50s and 60s, I might actually be able to sneak away to build it without my wife dying of exhaustion (and me missing the critical kid years- see “30s” above).

Conclusion

I don’t have time to share all that I took away from this book, much less impress upon you the importance of managing not just your money but your (and your loved ones’) finite health and time.

To be clear, this is not a book advocating for financial stupidity. Bill Perkins actually comes from the finance world. He’s simply reminding us that while mindlessly spending money is harmful, mindlessly saving money can be even worse.

While some of you reading this should be more frugal and save more for retirement, some of you financially responsible, ever-deferring Americans need to wake up from autopilot.

This is your life.

Your energy, your health, your time - these are the limited resources you need to be managing - not your Vanguard accounts.

Beyond these four concepts, Bill addresses everything from fear over end-of-life costs, peak utility of money (at what age does a dollar matter most?) to how he plans on actually “dying with zero”.

For now, maybe it’s enough to pause and ask yourself:

What’s the biggest opportunity in your life right now -

that may not be there in ten years?

We don’t know how long God will give us on this side of eternity. While I certainly disagree with some of the selfish, “YOLO" vibes that can come through Perkins’ writing at times, there is a wisdom in this book that we would be wise to heed as we strive to manage our finite time on this planet. And that’s why I heartily recommend a discerning read of “Die with Zero”.

“Teach me to number my days, that I might gain a heart of wisdom.”

- Ps 90:12

It’s Time for a Raise

It’s time to get back on the wagon with our finances.

To be clear, we haven’t been complete money slobs since we had kids. Yet, almost as a rule, we’ve consistently passed over rental properties in favor of minivans and traded maximum mutual funds for modern-day time luxuries like raising our kids at home. And you know what? I wouldn’t trade it.

These days, though, with kids about to head off to elementary school it’s time to play financial catch-up.

Enter the deceptively powerful side hustle. Let me illustrate its power with an example.

Fictional Frank’s Favorite Function

Fictional Frank is making $50,000/year with a savings rate of 20%. In other words, Frank is putting away $10,000 per year towards his long term goals. Not bad.

However, let’s say Frank picks up a side hustle selling homemade mugs, netting himself another $10,000/year. This amount might seem unimportant compared to his $50k salary.

He might ask, “Is all that mug-making work worth it for a mere 10k? Will it actually move the needle?

Enthusiastically, I say “Yes!”

Hidden beneath Frank’s humble $10k/yr side hustle is the fact that Frank has just doubled his savings rate. Translation: wherever he’s going with his goals (retirement, lake cabin, South of France, etc.) Frank will cut his time to reach his goal in half with this small side hustle.

(Bonus: If he can add another 10k/yr he has now tripled his savings rate. He’s cut his savings time by 2/3. Invest the proceeds and the effect is even more powerful.)

Even better, this new income exists outside of his 9-5 gig. Unlike a bonus or raise, this new 10k/year is not at the mercy of his company’s revenue, his relationship with his manager, or some recession which may or may not come.

“Fine” I can hear you saying, “I guess I wouldn’t mind doubling or tripling my savings rate”, I’ll just google ‘side hustles’ and take the first thing I see.

I wouldn’t do that.

One Size does not Fit All

Despite all the side hustle talk on the internet, few content creators distinguish between the sizes of side hustles and how they may or may not fit into your life.

Young and kidless? You’ve likely got bandwidth to go big (like I kinda-sorta did). Look up Brandon Turner. Alex Hormozi. Or Codie Sanchez. These are the current-day kings of the “big millionaire side hustle”. They’ll push you to add skills, put in long hours on nights and weekends, and build something that scales big and quick.

Side Hustle For the Time-Starved

For many of us, that kind of hustle isn’t possible (or desired). Do not despair. Even the most time starved among us (busy parents included) can still find a side hustle that fits without nuking your family in the process. You’ll need to be picky, though, and select only side hustles that are flexible, low-time, and low-energy. No home runs for you. Instead, you’re going to hit regular and frequent singles and it’s going to dramatically change your financial future.

Ok, enough about you - let’s talk about me :)

Here’s one busy dad’s plan to try and drum up an extra $50k or so in the coming year. Perhaps one of the ideas could work for you if you’re in a financial pinch.

Speaking of a financial pinch…

My Side Hustle Plan

1. Poop with Purpose ($14,000)

There is a literal crapload of research going on in the world of gut biota. Specifically, companies are successfully researching how to use gut biota from a healthy “#2” to heal everything from IBS to obesity(!). It’s an incredible medical advancement, but it’s one that requires tremendous amounts of doo-doo. What the crap does that mean for your finances? Ladies and gentlemen, you are currently living in the age of poo for pay.

Don’t believe me? At this moment, there are people pulling down $180,000/year as professional poopers. If you live around the twin cities, odds are you’re (literally) flushing money down the toilet every single day.

The place I donate at is Rebiotix in Roseville, MN. Their mission is focused on eliminating a difficult digestive condition called C. diff. Willing donors can expect a more purposeful poo in addition to up to $60 per day with qualifying “donations”. With the other perks ($50 for biweekly COVID tests), I’m hoping to average about $300 per week. That may not sound like much, but if I can do it, this little morning habit will net $1200/month… which amounts to $14,000/year!

Throw in a spouse and you can double it. For fun, I did the math and (incredibly), an eligible couple could make up to $46,400 dollars per year for going to the bathroom.

If you do it, please mention my name as a referral when you sign up!

2. Bank and Credit Card Bonuses ($15,000)

Free travel is great. By the end of this year, Lord-willing, I’ll have made it to Spain and Portugal, Japan, Quebec, and Italy - all for free. In addition to the free flights and hotels, I try to regularly hit lucrative bank signup bonuses for cash.

Whether it was Royal Credit Union in the spring for $600 or Amex business checking accounts last winter for $2400, making bank and credit card signups a discipline can accrue into a massive (often tax-free) financial boost.

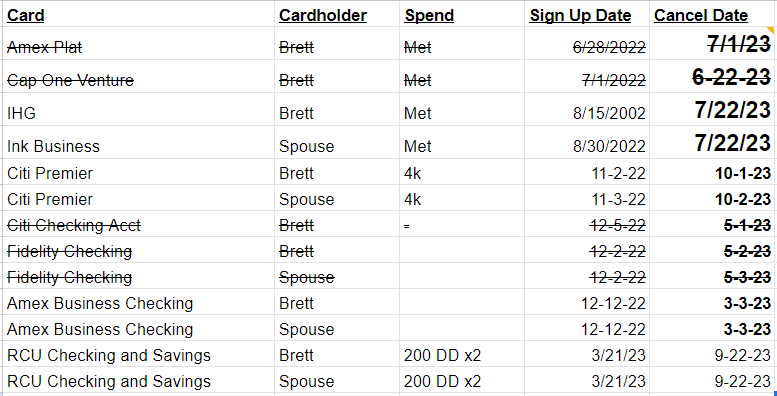

Typical tracking spreadsheet for me

When you total the signup bonuses (and my recently opened 5% interest checking account from Wealthfront), I’ve made over $15,000 in the last year from comfort of my porch and I’ll be continuing this discipline into the fall.

Big Pink Box: If you’re interested in hearing when I’m doing a card / bank bonus, just shoot me an email (brett@brettwrites.com). I’ll try to remember and loop you in on some of the stuff that I’m up to in realtime.

3. Fire my property manager ($18,000/ year)

Less than a month into our third kid, our rental property basement was drowning in melting snow - and we were drowning in babies. So, after a near-flooded basement in 2019, we reluctantly hired our first property manager.

The good: I’ve been able to keep my properties through the most intense years of my life.

The bad: The results have varied from “acceptable” to “nauseating”

The ugly: My property managers have generally been asleep at the wheel. The one thing they have been consistent at is charging massive amounts of money and neglecting my tenants. Sure, the $90/unit fee sounds amazing… but the reality is that the costs (placement and renewal fees, vacancies, turnover, and on and on) may eventually run your business into the ground.

I’m banking that even a half-ass job from myself, or honestly, even a “1/10 ass job” when I’m on the other side of the planet, can provide my tenants with a much smoother experience- and save me $15k-$20k/year in the process.

4. Etc

Pre-school is finally ending for us! ($6k/year savings). My wife is going to sub part time in the fall! ($10-20k/year?) And who knows what else will come up in this crazy land of opportunity we call America?

Let’s goooooo!

Conclusion

We all want a raise, don’t we? If you’re like me, though, you’d rather not wait around for an employer who may or may not come through with an end-of-the-year money shower. With recession clouds looming, I’m taking matters into my own hands.

What about you? Would you consider a side hustle if it meant reaching your goals in half the time (or less)? If so, what’s your side gig?!

Free Travel FAQ

In my last post, I introduced the concept of using credit card signup bonuses to travel the world for almost nothing. If you're like me in the beginning, you've probably got some questions and concerns. Let's take a look at some common ones.

This sounds scary. Won't this ruin my credit score?

This strategy, used over time, will help your credit score. Mine has been in the 800s for years. The fear around signing up for credit cards comes from not understanding how your credit (or FICO) score is calculated. The factors that go into your score are:

On-time payment history (35%)

% of total credit used (30%)

Length of credit history (15%)

Credit mix (10%)

New credit (10%).

After getting a new card, here’s what happens:

Small dings

Credit pull. (any time you pull your credit there’s a tiny ding). Tiny impact that lasts < 1yr.

New Credit. (because you opened new credit) Minor impact as it’s only 10%. This impact goes away if you cancel card eventually.

Length of Credit History. Minimal impact that becomes negligible if you have an older card that’s been around for a few years. This impact goes away if you cancel card eventually.

Why it goes up

On-time payment history. This is the biggest contributor to your credit score so when you pay on time with a new account you are significantly helping your credit.

% of total credit used. This is the second-biggest contributor to your credit score so when you add new credit, your score goes up (as your utilization % has just gone down).

In the end, your credit should go up. This strategy isn’t much different than what “credit repair” companies do to help their clients increase their credit score.

Who should do this?

People who:

Will for sure pay off their credit cards in full and on time.

All benefits are negated if you end up paying the insane 18% interest or spending more than you otherwise would.

Have a decent credit score

The huge bonuses require an excellent score, but if that’s not you, applying to some smaller cards/bonuses will help you get there.

Can handle some details, are flexible and willing to learn

You’re adding some complexity to your big purchase and your travel. Over time, though, you’ll be able to do it without thinking.

What do I do with the card after I've got the bonus?

You may want to keep using it. For instance, I've kept my IHG card over the years despite the $49 annual fee because they shoot me a free night every year that we use as an excuse for a fancy getaway.

For other cards, you may decide that the long-term benefits aren't worth the recurring annual fee. A good time to close these accounts is 10-12 months after applying for the card.

What if I'm not that into travel?

As much as I love to travel, I get this. After having kids, our appetite for travel all but vanished. The cool thing is that the same habits that get you free travel can also simply net you cash rewards.

Those 100,000 Chase rewards points from last year are also worth $1000 cash. Of course, they could be $2500+ in travel, but if that's where life has you, feel free to take the thousand bucks!

How crazy can I go here? (How many cards can I do at the same time?)

More than you think, but not infinite. The main rule that's come out in the last few years is the Chase 5/24 Rule. Here's the rule:

To be accepted for a Chase card, you can't have opened more than five cards (from any cc company) in the last twenty-four months.

Chase cards are usually the best, so it's good to plan around this (either 2 cards/year or a big splurge and then a long break)

Can I do a card multiple times?

For Amex cards, no (1 bonus per card per lifetime). For Chase cards, yes, after about 4 years. More details here.

Can my spouse sign up for 2x the goodness?

Yes. One great benefit of being married is that all this free travel can be doubled. When you see a good bonus, you can sign your spouse up too for 2x the points.

Do you have any more examples of how you've used this strategy?

I suppose this is where I confess to my exploits to get you fired up enough to try it.

Internationally, I’ve notched free trips to Peru, India, and Europe.

My intense 2015 spreadsheet from our free-flight, mostly-free-hotel, free-rental-car trip to Switzerland, Germany, Italy, France, Denmark, and Hungary

Domestically, I’ve logged free trips to Alaska, New York, Los Angeles (countless times), Milwaukee (countless times - kids under 2 fly free and boy did we know it), San Francisco, Denver, Florida, Charleston, and Minot.

We've used our hotel points and free nights for everything from local getaways to $600 suites in the heart of Paris.

Speaking of free lodging…

I’ve still got to pay for hotels/Airbnbs, though. Is there any way to do those for free?

After booking free flights, many will be content to pay cash for their lodging. For tightwads with remaining gusto, you may wonder: how can I get free lodging too?

There are two ways that I know:

Free Lodging Option 1: Repeat the Process with Hotel Cards

At the time of writing there's an IHG hotels card (think Holiday Inn, Crowne Plaza, and more) that gives you 125,000 points for signup - along with a free night every year. Or there’s a Hilton card that lands you 130,000 Hilton points.

If you are able to meet the spends, this creates a powerful combo of free flights and free hotels.

Free Lodging Option 2: AirBnB Your House while you're gone

By now, most of us have stayed in an AirBnB. Have you ever considered hosting while you're gone? While you're travelling, the reality is that your house is now unused. If you have time to clean it before you go (and move out any sensitive documents, etc), you could have someone pay to stay in your house, offsetting the cost of your own stay.

This option gets interesting as you may be able to net positive income from your trip (i.e. getting paid to travel).

What is the best card for frequent traveling?

For frequent domestic travelers, the holy grail is the Southwest Companion Pass.

At the time of writing: If you get the SW personal card (40k points) and SW business card (80k points) at the same time you will have 120,000 Southwest points. In the process of meeting those spends, you will add another 6,000 points. This gets your total to over 125,000 points in a year which automatically gets you the Southwest Companion Pass for the rest of the year and the following year.

The Southwest companion pass is a reusable BOGO pass for flights. When you have the pass, every flight you book with cash or with your giant point stash nets you another free ticket.

tl;dr: For those who can meet the spends early in the year (January being the best), they essentially have free travel for two years (for two people).

And you can repeat it in two years with your spouse. And then you can do it in four years again…

Isn't travel hacking harder to do nowadays?

Anyone who's been doing this for five years or more could regale you with tales from the "glory days" (ask me about my free month in Europe some time).

This is a game that's always changing and it has gotten marginally more difficult. But if I can still get a family of five to the south of France and back for nearly free in 2022, I'd say it's still a game worth playing.

Where can I learn more

This is just an intro post to an entire world of free travel. For more, check out:

(why are they always guys? What about points girls?!)

How do I parlay my big expense into free travel and help support this blog?

Just use the links on my credit card page. One card signup funds this blog for three months.

You Can Travel for Free

Learn how to play a new game…

This is a brief intermission from the “Faith in the 21st Century” series we’ve been working through. We’ll be back in the deep end soon, but for now, it’s time to travel!

Back in 2012 some friends invited me on an epic trip to Peru. I wanted to go so badly, BUT the $1300 plane ticket (plus everything else) was just too much for my starting salary. With a stack of loans taller than the Andes, I was so sad that I wouldn’t be able to make the trip. Except…

I went anyways.

The key was not “YOLOing” my way into debt, but rather in stumbling upon a strategy that enabled me to be “young, wild, and free” without going broke.

Mystery booth

Before a work flight, I noticed a credit card booth at the airport with a sign that read: "Earn 50,000 bonus miles upon signup". At the time, I ignored it (sounded too scammy).

It was only when faced with my Peru FOMO that I remembered that booth. After a simple search on the airline's website, I learned that 50,000 miles was enough for a round-trip to Cusco, Peru on those exact dates. So… I signed up for the card.

The crazy idea worked. I scaled the Andes, volunteered with a non-profit, and even rode a scooter through the Amazon. I deepened friendships and gained perspective on big decisions (I was married a year after the trip, for one).

Best of all, I did the three week trip to Peru for very little money, with no negative consequences on my finances.

Rinse and Repeat

Emboldened by my South American experience, I repeated the process. Over the last ten years, I've gone everywhere from India to Alaska. In a few months, we’ll be in France.

The thing is… I still haven't bought a plane ticket (with money).

What does this mean for you?

I’m not sure if your hobby is golf, poker, or underwater basket-weaving - but let me share another game with you. This game has rules, details, and strategy too - but it rewards you with free travel for life.

Here’s how you play.

How to Travel For Free

o. Cue: Big Upcoming Purchase

In the free travel game, you get huge miles when you spend a certain amount on a new card (e.g. $2000 in 3 months). Therefore, the process kicks off when you know you’re about to spend a big chunk of money. Rather than putting that new Peloton (or medical bill or whatever) on your standard old 1% back card, you instead get a new card(s) with a juicy signup bonus and put the big purchase on that.

For example, my big purchase last year was finishing my basement. By putting Home Depot purchases (and even my drywaller) on new cards, I realized that I could probably do a pretty big trip.

1.Pick a Destination

When you know you’ve got a purchase coming, you should pick a destination, preferably one that makes your heart beat a little faster :)

For my example, I recognized that with the size of my big purchase I could get ambitious. I asked myself: could I get my whole family to the French Riviera?

2. Create a Card Plan

Now that you’ve identified a purchase and picked a destination, we need to map a “credit card route” to get there.

Figure out your Airline Options

First, we’ll figure out how many “miles” it will take to get to your destination. Just go to a few airline sites, check “book with points”, and write down what you find. For example, here’s a 17,500 mile trip to Los Angeles.

This is Delta. Feel free to check out American, United, or any other airline that goes to your destination.

Card Options

Second, let’s brainstorm some card possibilities to earn those miles (if you’re confused, the next picture should make it clear.) To find the best card bonuses, search Google, check out my credit card page or play with the Mad Fientist’s tool.

You should now have airline options and corresponding credit card options. Now let’s play the matching game.

Here is a real-number example for an LA trip (with a box around the combo I would choose):

Lots of options, but I’d go United - and bring two friends! (50k covers 3 United tix!)

Black-Belt Example: Five to the South of France

For our upcoming France trip, the best airline option was Air France at a steep 300,000 Air France miles.

Thankfully, Chase and American Express were foaming at the mouth for new customers in early 2021 - and their points transfer to Air France. We obtained the needed miles with just three cards.

Me: Chase Sapphire (100k), My wife: Chase Sapphire (100k) and Amex Platinum (125k)

3. Apply, Spend, and Book

Ok, by now you’ve got a purchase, a destination, an airline to get you there, and a credit card (or five) to get you the needed airline points. Congrats! You’ve done the hard work. Now, it’s simply time to execute the plan.

Go ahead and apply for the cards. Don’t be nervous - we'll talk about credit scores and all that in the FAQ. You’ll be accepted on the spot or you can call them if you need to.

When the card arrives, activate it and make your big purchase! (Sign up for autopay too so you don’t forget.)

Once you’ve spent the $, your bonus should show up in your account in a few weeks.

Now go ahead and book your trip with the miles!

Oh yeah, and last step: Go!!!

Conclusion

Travel can be fun, restful, or even life-changing.

In the past, world travel required significant costs, and therefore trade-offs, with other financial goals. Today, that’s different.

Eager credit card companies have made a way for organized middle-class Americans to see the world.

If you are new to free travel, I know you've got questions. Click on the left for some answers. Click on the right to try it out (and support the blog at the same time)!

Where are you headed next?!

or to grab a card…

Investing Follow-up: FAQs

The content of my investing post is far from original. If you know about index funds, this is old news. My hope is that through that article a few readers came away with a better understanding of investing (and index funds). If that’s true, you’ve probably got some questions.

1 or 2% fee - what's the big deal?

1% sounds small. But in the world of investing, the results are MASSIVE - particularly over time.

For instance, just a 1% fee on a 10,000/year investment over 40 years would lose $600,000 in value. You read that right.

If you're paying a one percent fee you are making a half-million dollar donation to the richest people on the planet.

In a world where fund managers don't matter, the FEE is the thing you need to pay attention to.

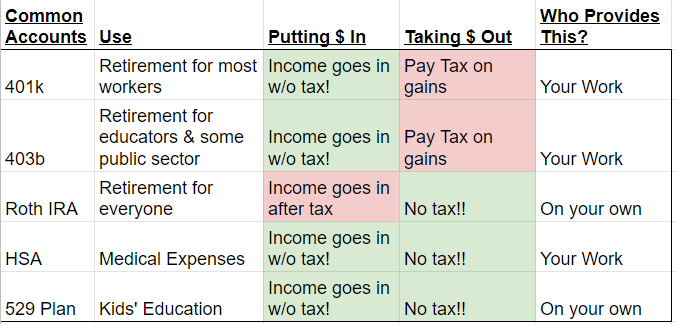

What do I mean by a tax-advantaged account?

If you think 1 or 2% fees can wreak havoc on investment gains, imagine what 15 or 20% taxes can do. Thankfully there's a number of ways to significantly soften the blow in the US.

But what about my nephew who made $100,000 on ____ stock?

People make it big all the time on individual stocks. People lose their shirt all the time on individual stocks. That ones who make it big make the papers (or just tell everyone). The ones who lose everything don't.

Buying individual stocks can be fun, but should be treated a bit like going to the casino. Your odds are actually much better than the casino depending on the stock- but because you don't know the future - and stock prices are subject to all the emotions and irrationality of humans - they can fluctuate wildly and trying to predict this over time is futile.

The biggest benefit of a basic index fund is that your mind is now freed up from thinking about what to invest in, analyzing companies, etc. to focus on making lifestyle changes so you can contribute more (picking up biking for instance).

What about crypto?

I actually know someone who is up $100,000 in a month on a $10,000 crypto purchase. I’m not going to try and replicate it and neither should you.

For cryptocurrencies, take all of the irrationality and craziness and price fluctuations around an asset like stocks. Now take away the underlying asset that has real value and keep all the gambling and weird psychology (with a heavy dose of FOMO) around them. Boom. You've got cryptocurrency.

Remember that stocks have real inherent value - that Ford stock means you really own factories and intellectual property and everything that Ford owns. With crypto, there is no inherent value.

While blockchain is an intriguing technology that may or may not play a role in the 21st century, crypto currencies are something different altogether.

By definition they are not an asset. They don't produce anything over time - and they don't try to.

Unfortunately, they're not even currency. Until a crypto currency is a store of value, unit of account, and medium of exchange (the marks of "money") it is nothing more than a fascinating zero-sum experiment in human psychology, FOMO, and Greater Fools. Like with any speculative game, many will make money and any will lose money. Of course, feel free to play the game as much as you want with money you could comfortably lose.

Just don’t call it investing!

What about Warren Buffett?

I love Warren Buffett’s story. He is one of the few people who has beaten the market over his career and also he’s just an interesting person. Does that mean I should try and imitate him?

Probably not.

First off, he’s brilliant.

Second, he’s spent his entire life reading over financial documents - since he was about ten years old reading over financial statements. It’s his favorite hobby.

Third, how did he make his money? 99.99% of the time, the rules of the index funds are all you need to crush other funds. Every once in a great while, though, there are times when a very smart, cool-headed, cash-heavy independent thinker can outperform. Generally it’s in a crash.

Warren Buffett’s made a number of good investments over the years (though he’s been crushed by the index over the last fifteen years). But his best investing moments were stepping into what appeared to be a burning building and buying shares in that building for dirt cheap as people ran out screaming.

Fourth, the most underrated aspect of his success is his longevity (he’s invested in stocks from age 10 to 90, with 90+% of his net worth coming after age 70).

Fifth, here’s what he recommends to people (including his wife for after he dies) about making money in the stock market:

“I recommend the S&P 500 index fund”

Warren Buffett

I already know this stuff. Anything more advanced?

Sure. If you want extra credit (by that, I mean extra money), there are some advanced stuff you can learn about. Note that the advanced stuff isn’t about stock picking - it’s about lifestyle design and tax minimization:

Design Life to Maximize Contributions

If you’re able to bump up your savings rate beyond the 15% you can retire earlier- much earlier. In fact “years left working” is simply a function of one variable that’s in your control: your savings rate.

Ride a bike: After housing, transporation is the second biggest budget item for Americans. Luckily, you can reduce or eliminate it completely through biking.

The best resource on designing an efficient life is Mr. Money Mustache. It is truly the PhD in personal finance and what is possible for those who can live a bit more simply.

Avoid taxes altogether:

Roth Conversion Ladder: You can combine the power of your 401k and your Roth IRA to pay no tax going in AND no tax going out. It's called a "Roth Conversion Ladder" and while it's been in effect for decades, it's currently on the chopping block as a loophole Biden wants to close.

HSA: The Ultimate Retirement Account: Log your HSA expenses right away - but don't reimburse yourself until you need the money (preferably after retirement). Result: Tax free contributions, tax free growth, tax free withdrawals. Crazy.

Small-Cap Allocation: While the principle of index rules are more or less perfect, what’s not yet perfect is the weighting of the stocks in that index. VTI weights by market cap (the bigger the company, the more VTI has of that company). This means that most of what you buy in VTI is Apple, Amazon, and the other huge tech companies. By shifting the weighting towards smaller companies (but still using Vanguard index funds), there’s a good chance that you could outperform VTI in the long run.

Buy a Rental Property: If you’re willing to take on a bit of hassle, you can get returns that can crush Warren Buffett. And you might become a better person in the process (see link).

Retire in your 30s: That’s right. Most middle-class Americans can retire in their 30s if they're willing to put their extra money towards freedom instead of stuff. There’s a whole movement behind it.

What questions did you have around index funds or investing?

Investing: A Simple Zero-to-Hero Guide

"Over the years, I've often been asked for investment advice, and in the process of answering I've learned a good deal about human behavior. My regular recommendation has been a low-cost S&P 500 index fund,"

-Warren Buffett

There is a whole industry dedicated to increasing people’s height with pills. It's as scammy as you think it would be.

But I think back to when I played basketball. Back in ninth grade, basketball was my life. The problem? I was only 5'3". I needed to grow and I didn’t know much about what made people grow taller. Had I known about height pills, there’s a non-zero chance I might have fallen for them.

If I had bought ‘height pills’, I'd be out money. At worst, I would actually hinder my attempts to grow or even compromise my health.

So what do scammy placebo pills have to do with investing?

While most of us realize the stupidity of wasting money on something as pointless as height pills, this is exactly what most people do with their investing.

The difference is that with the pills we’ll be out a few hundred bucks. With our retirement accounts, it means losing out on hundreds of thousands of dollars over your lifetime.

In the investing world, these expensive placebos are called:

Mutual fund managers

Mutual fund fees

This usually costs investors far more than they understand. This happens because otherwise smart people lack a few simple concepts.

In this post, we’ll:

Take a whirlwind tour of what investing is

Recommend a single, practical action to give you maximum returns with almost no effort.

This action will allow you to retire with way more money in your pocket. If you’re young enough, this will most likely make you an automatic multimillionaire.

Investing Lessons from 20th Century

Back in the late 1800s, stocks became a thing. For the first time, average proletariat Joes could easily become capitalists, owning shares in massive, powerful companies for just a few dollars.

Stocks

A stock is part-ownership in a company. If you buy a share of Ford, you own a small sliver of their factories, the cars in stock, their intellectual property - and most importantly, you are entitled to your share of their profit, called a dividend.

Sounds pretty good, right? It is. That's why people are willing to pay for shares of Ford - about $18/share at the time of this writing.

As the company gets more productive and population grows (so there’s more people to sell to), the dividends get bigger and the price of the stock goes up.

The problem with individual stocks is that they were (and are) risky. A company can blow up 10x - or they can just blow up - to zero.

The question "What's a good stock to buy and at what price?" is hugely complex - and futile, as we'll see.

Mutual Funds

To solve the problem of concentrated risk, investment companies came up with a great idea in the 1920s. What if a bunch of investors got together to "mutually fund" the purchase of a wide number of stocks? It would allow ordinary people to get the gains of the stock market while spreading the risk over hundreds of companies instead of just one. The mutual fund was born.

The companies would then put an expert "fund manager" in charge of the picking, buying and selling the best stocks for the fund so Joe Schmoe investors could participate without having to know anything about investing and still profit.

Even though significant fees were involved to pay the fund manager and package the investment, the mutual fund was a huge step forward for the average investor.

Pointless Millionaires

Things progressed this way for a long time, with many people benefitting - particularly the fund managers. But in the middle of the century, some astute researchers started to notice something that was as unexpected as it was important.

Incredibly, they noticed that no fund or fund manager was regularly beating the market. For all the time and effort that smart, Harvard-educated Wall Street fund managers put in, they couldn’t pick stocks that were better than a simple average of the big companies in America (S&P 500).

Sure, on a given year, some beat the “index” - but most didn’t. And the ones that did beat the index quickly became the ones that didn’t. The ability of a fund to beat the simple average of the market was random.

In other words, all the billions of dollars in fees paid were a complete waste of money.

You read that right. Throwing darts at the "Stock" section of the Wall Street Journal will produce the same result over time as hotshot fund managers, even with the help of legions of analysts, corporate middlemen and brick and mortar locations on the most expensive island in the world (Manhattan).

This was a watershed moment - or it should have been.

These findings raised a question - THE question: "Why are we paying them so much then?"

The rational (and ethical) action for investment companies to take was to inform the public that their fees were pointless, shutter their doors, and turn off their personal trillion dollar firehoses that were making them the richest people to ever walk planet earth.

They promptly made the tough call to fire their fund managers and return the money back to the investors.

You didn’t really buy that, did you?

Wall Street firms changed nothing. They kept offering their funds, complete with hefty fees, and almost no one was the wiser. They’ve done it for decades and continue to this day.

Index Funds

Back in the seventies, one man decided to do the right thing. His name was Jack Bogle. In 1975, Bogle started a company called Vanguard. Bogle put into practice what we now know about the inability of even the smartest people to pick stocks.

Bogle took pride in not being a billionaire

Instead of hiring a hotshot manager with a team of expensive analysts, he replaced the traditional fund manager with a set of rules: "Own the 500 largest companies in America". Instead of paying someone to try and beat the market, he set out to be the market, providing the historical 8% returns without any of the expensive fees. When you include fees in the return, this new “passive” fund crushed other actively managed funds over time.

The rules made sure that its investors were invested in the most successful companies in the world without the downside risks of individual stocks. The best part was that the "rules" managing the fund didn't require a 200-foot yacht or a 4-story penthouse in the upper east-side.

His miniscule fee was just enough to pay his salary and run his office in Pennsylvania. The savings he gave back to the investor.

By doing this, he effectively passed over tremendous personal wealth as another hotshot fund manager, instead transferring trillions back to investors.

This is why Bogle has been called the greatest undercover philanthropist of all time and the index fund as sitting alongside “the invention of the wheel, the alphabet, Gutenberg printing press and wine and cheese.”

Crazy story, right? What does it mean for you?

Put it Into Practice

For most people (who don’t want the higher-work and higher-returns of rental properties), a Vanguard S&P index fund should be where you put your money. It turns out that all the findings of the last century can be applied with one simple action:

Buy as much VTI as you can in a tax-advantaged account and leave it there as long as you can.

VTI is Vanguard’s flagship total market index fund. You can go to vanguard and set up an account right now. Even better, set it to auto-invest 15% of your paycheck or so to ensure future millionaire status. Mix in some bonds (30-40%) close to retirement.

The arguments for this simple strategy have been borne out over much data, research and time. See:

Simple Path to Wealth (Book by JL Collins)

Little Common Sense Book on Investing (Short book by Jack Bogle himself)

How to Make Money in the Stock Market (Blog post by Mr. Money Mustache)

Just to name a few.

This advice shouldn’t be controversial, but there will always be people in the investing industry who still profit from ignorance. Don’t be surprised to find a few still selling the idea that they or someone they know can beat the market over time - though a few minutes of research will prove them wrong.

Conclusion

Investing has come a long way in the last century, both in our understanding and the products available to the average investor. Index funds have made it extremely easy for people to maximize stock market returns over time.

Way back in ninth grade, I stayed the course. Even while I stayed at 5’3” and people got taller around me, I drank my milk, ate a lot of food and most importantly I didn’t pay some guru promising “extra growth” for a hefty fee. The result? By junior year I had grown an entire foot. By simply taking what my genes gave me I grew more than I thought was possible. We need to do the same with our investing.

Buy index funds, forget the headlines, and let the magic of markets do the rest.

Got Questions?

If this is your first time learning about investing or index funds I’ve put together an FAQ to answer some of the questions that I had when I first heard about index funds. Read it here - cheers!

Comment

Subscribe

Share

What role do index funds play in your investing life?

Drop your thoughts below!

Who do you know who could use this post?

Biking: The Ultimate Life Hack

Extra money. Healthier body. Happier mood. Connectedness to our community. And throw in a healthier environment to boot. What if there was a tool that could achieve all of these at the same time?

It’s the ultimate life-hack, but it’s not a pill or a mantra or a diet plan. I submit to you the humble bicycle.

My $50 college bike, still rocking after tens of thousands of miles

You’re skeptical. I get it. Here in America, bike transportation is for kids, homeless people, and suburban white guys in spandex.

But functional biking- the kind where you’re actually running errands and living your life on a bike instead of a car- has the power to dramatically impact the most important parts of our lives.

Your Bank Account

Take finances. As a three-kid one-income house we know what it’s like to have a tight budget. And I know that with 40% of Americans living paycheck-to-paycheck I’m not the only one.

So check this out. The IRS (not typically known for lavish generosity) puts the cost of driving at .56/mile.

This means if your coffee shop is just 3 miles away, then according to the IRS you double the cost of the coffee by driving a car ($3 for the coffee, $3 for the ride there and back). Your 15 mile commute? That’s costing you $16 per day- that’s lunch, or a netflix subscription, or a new shirt- Every. Single. Day.

We drivers equate the cost of driving with the cost of gas- but that’s like saying the worst part of smoking is that your clothes smell a little funny. The cost of driving includes gas but it’s also the payments and interest, the oil change, the license and tabs, the parking, the parking ticket, the new tires, the timing belt and on and on and on that puts the cost at .56/mile or more in many cases.

Think of your bike as having an invisible money printer attached to it, printing off a $10 bill every time you hit the 18 mile mark (which for many people is just a daily commute or a trip to their friends’ place).

Americans on average spend $10,000 every year on their automobiles. What would you do with even half of those dollars back?

I’ll end this section with a quote from Mr. Money Mustache, a personal favorite and arguably the king of internet personal finance. Here’s how he would distill all of his personal financial advice spread across his hundreds of blog posts:

If I had to strip [the blog] down as far as possible, down to just one single action, and I wasn’t allowed to talk about anything else, the choice would still be simple: “Ride a Bike”.

Your Health

By now we know that Americans are growing more unhealthy every year. With a 40% obesity rate in the US and 3/4 of us not getting enough exercise it’s clear that modern life makes it hard to stay in shape.

I get it. With three kids, a full-time job, and multiple side hustles, I don’t often have the time and energy to get to a gym.

But I will go to a coffee shop to work. I’ll go to the doctor and the dentist and I’ll bring my kids to the park.

And I can bike to every one of those places.

By turning these car trips into bike rides, it’s not hard to get the 30 minutes of daily exercise that doctors suggest.

Can you sense how sneaky the power of biking is? Rather than trying to add in one more thing, you are building exercise into the fabric of your life.

Your Happiness… and Connection

When’s the last time you had a sense of childlike joy? Of freedom? Of connection with the world around you? If you’re like me, that sort of feeling can be hard to come by. “Adulting” is hard work- and with one in six Americans now getting help from psychiatric drugs (usually for anxiety and depression) it seems we could all use a boost in the happiness department.

I vividly remember my first “functional adult ride” when I pulled out my Peugot back in 2015. In that short ride to Redbox, it was impossible to miss the sheer childlike joy that was injected into this ordinarily-mundane trip. For 23 hours and 45 minutes that day, I was a full-fledged adult. But for 15 minutes I was a kid again.

I also noticed way more along the way. I nodded to neighbors in their yard or on the sidewalk. Instead of hopping into my giant steel box and magically popping out somewhere, I interacted with my route and each house, person, and business I passed.

It’s no wonder that biking is the happiest mode of transportation we have and that too much time in the car makes us miserable.

We’re made to be out there in the sun, wind in our face, lungs breathing deeply- present with our community and present with our world.

Seeing… and Removing The Obstacles

I’m sure you’ve got reasons why you don’t think you can bike- I know I’ve got mine (3 kids, chronic back pain, living in frozen Minnesota, etc. etc. etc.), but they all can be overcome- usually pretty easily.

Just another January ride in Minneapolis

For me, my kids ride in a Burley that I got for $50. For cold weather, there’s another great invention called clothes that help you ride no matter the temperature. For you the excuse might be distance- and you’re in luck! You’re living at the dawn of the affordable ebike- which helps people blaze long distances in little time with literally no sweat.

Of course, my sneaky goal that I’d never tell you on this blog post is to get you to consider a more fundamental shift: living close to work, friends, groceries, and all the places you go. But we’ll save the exponential power of proximity for another post. First we’ve got to get that bike out of the garage.

Conclusion

For some, the benefits of biking are old news. For the rest, I’m hoping that you’re starting to see this two-wheeled throwback from your youth for the wealth-generating, gut-slimming, happiness factory that it is.

Ok- that’s enough sitting for both of us. It’s time to pull our bikes down from the rafters (or Craigslist) and blow off the dust. I’ll see you out there!

Comment

Are you a “functional” biker? Why/Why not?

Drop a thought below!

Subscribe

Share

Who do you know who might benefit from this post?

Rental Properties… What’s That Like?

My Investing Story: How one cup of coffee turned into six rental units

My life changed in a coffee shop in 2012.

I was fresh out of school and like any good millenial I was up to my eyeballs in student debt. But I had just taken a “Dave Ramsey'' finance class and for the first time I was thinking about money, work, and freedom.

I had also been on a kick of buying cups of coffee for people who were smarter than me - anyone who could teach me something. When I texted my old college buddy, Pat, to meet up, I had no idea that he was about to fundamentally alter the next decade of my life. As we sat down in our old college cafe, I started sharing about how I was slowly working through my student loans, how I was thinking about opening up a 401k at my job, and all the other standard “financial stuff” when he stopped me.

“Brett, we are in the middle of the biggest real estate clearance sale we will ever see in our life. Mutual funds are great and all, but you need to stop what you’re doing and start buying investment properties. Right now.”

Ok, Pat, I get it. Also… I think you’ve had enough coffee.

At the time I didn’t know that real estate consistently builds more wealth than any other asset class. I didn’t even know that my twenties were an excellent time to invest in real estate. All I had was my conversation with Pat echoing through my head along with an intense desire to kill my student debt so that someday I could start a family. And believe it or not, that was enough.

Six months later, with all of $12,000 to my name, I bought my first house on a 3.5%-down FHA loan. This would kick off a 4-properties-in-4-years buying binge, culminating in owning my own house along with six rental units.

So yeah. We’ve got properties. But that’s not what you’re wondering. What you’re wondering is:

Has real estate investing been worth it?

Benefits: Wealth Rocketship, Priceless Time

In my case, the benefits have been… astonishing.

Over the last nine years, the cash flow from our rental properties has been more than able to dig us out of our terrifying chasm of student debt. The appreciation on the houses rocketed our net worth higher than I ever thought possible. Due to market timing, a heaping pile of luck, and the magic of leverage, we’ve had an ROI on those down payments that would make Warren Buffett shoot Coca-cola out of his hundred-billion-dollar nose.

More important than the dollars we racked up, the modest cashflow from the rentals allowed my wife to quit her job and stay home with our kids through the first pivotal years of their lives. In between all the kid-craziness, she’s been able to nurture them through the baby and toddler years, walking with them through this brief phase that comes only once.

My story isn't an uncommon one. Now in my thirties, one thing I’ve consistently noticed is that the friends who were intentional with their finances in their twenties are seeing their life options increase as they enter their thirties- while at the same time my less intentional friends are seeing their options narrow as kids and mortgages start to cement both calendar and budget.

Now I could end my real estate story here and confirm the rosy story that the get-rich-quick gurus are so quick to tell- but that’s not the whole story.

The (Literal) Crap they Don’t Tell you About

What the books and the gurus won’t tell you is that rental properties aren’t just numbers on a page. You don’t just make a few mouse clicks and get a statement at the end of the month. The minute you buy a rental property you have become a business owner. You are solely responsible for the home of other humans. You need to find and manage tenants and contractors, you need to learn about building maintenance and business systems, taxes and insurance.

Over the years I have replaced toilets, ripped out moldy sheetrock, and installed flooring. I’ve buried dead animals and I’ve literally had to remove ankle-deep sewage from a crawlspace. I’ve met incredible people I’d trust with my life and worked with contractors who have made me question my faith in humanity.

360 days of the year, you’ll wonder why everyone doesn’t invest in real estate- the other 5 days, you’ll wonder why anyone invests in real estate.

But all that brings me to the ultimate benefit of real estate that doesn’t get enough airtime.

Real Estate’s Ultimate (Hidden) Benefit

After reading about all those literally crappy issues, you might be tempted to run back to the Vanguard account from whence you came. Before you do, though, ask yourself a question:

Who do you want to be in ten years?

Not just how much money or what stuff you want to have- what are you trying to do in life?

Are you looking for the easiest path you can find through life? Or are you looking to learn, to grow? To become a smarter, stronger version of yourself, ready to handle anything life throws your way (all while accelerating your financial returns dramatically)?

Over the years, I’ve picked up on a few common traits among the real estate investors I know. As a group, real estate investors are the people that go after the things in life that they want- they don’t just “wish”. They’re usually well-connected (real estate investing is a team sport after all). They’re opportunistic, they’re hard-working, and they’re smart across a huge range of subjects.

When I bought that 4-plex in 2012 I was a clueless 25-year-old kid- no practical skills, no financial literacy, little confidence and almost nothing by way of life experience.

In my nine years of being a landlord, I’ve learned and grown into a version of myself I couldn’t have imagined when I started. I’ve framed walls, replumbed houses, and wired basements. I’ve hired lawyers and battled with the city. I’ve learned the ins-and-outs of mortgages and the tax code. I’ve met lifelong friends and learned to work with people from all walks of life- rich and poor, contractor, tenant, zoning board member and neighbor. I’ve not only learned financial “savvy”- somewhere along the way I learned responsibility. Grit. Perseverance. Character.

Somewhere in those nine years, I became the person my friends come to for advice on everything from investing and finances to sheetrocking tips and even thorny people situations.

Conclusion

Like many others before me I got into real estate for “passive income”. I was wishing for an escape from work. But real estate tricked me. Through the ups and downs, the work, the growth- I’ve become someone who doesn’t want to spend the rest of his life sitting on the beach with a margarita. I want to learn. I want to grow. I want to provide value to my community.

Let’s shoot straight. Your question wasn’t about me, was it? It was about you. Should you invest in real estate? I say “yes”. If your time of life, your location, your personality, your finances, and your schedule allow, then this is a no-brainer.

I hope you make a ton of money. I hope you join the long line of ordinary people who utterly transformed their finances through real estate. More than that, though, I hope you grow into the most mature, confident, skilled, battle-tested version of yourself you can be.

Maybe the real question is: what would you stand to gain apart from the money if you entered this crazy rabbit hole we call investing?

Who could you become?

Comment

What have your thoughts / experiences been with owning rental property?

Drop a thought below!

Subscribe

Share

Who do you know who could benefit from this post?