13 Years (Part 1): Turning Our Life Around with Real Estate Investing

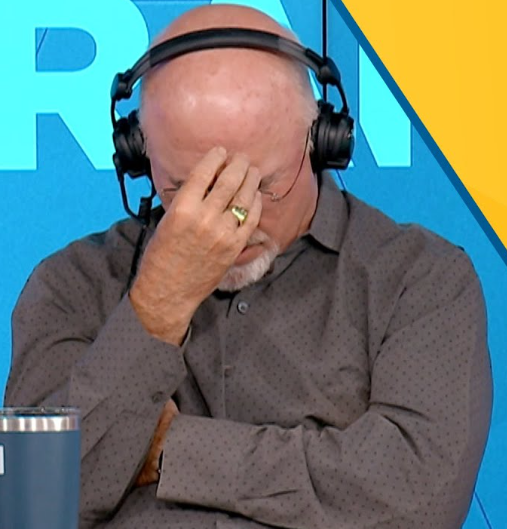

Real estate changed our life. To understand how, I think of what a call to Dave Ramsey would have been like back in 2012.

Back up a step. On Dave’s show, there are three kinds of callers:

Humble-braggers: "Hey Dave, I make $400k as an oil rig analyst and the cash under my mattress is starting to hurt my back."

Weird-nichers: "My aunt left me a $2M dolphin but I can’t sell with the Iowa Dolphin tax."

Train-wrecks: "I’ve got 6 masters’ degrees in underwater basket weaving and just noticed I’m $700k in debt. Is that bad?"

Back in 2012 we were heading for number 3.

Our Shaky Financial Start

Here’s how our call-in would have sounded:

Dave: “Hi, 2012 Brett. What’s your story?”

2012 Brett: "Hi Dave, I've got $50k in student loans and I just married a girl with $60k of her own.

Dave: “Wow, that’s $170,000 in 2025 inflation-adjusted dollars.”

2012 Brett: “Uh… ok. Anyways, I make $50k a year and have zero savings. Oh yeah, one more thing - we're about to buy a house, have three kids… and my wife won't be working for the next decade.What baby step am I on?"

We weren't a “railway carnage” case yet- but we were speeding down the tracks. Thankfully, we found a way to avoid the massacre.

A decade later, our debt is gone. Retirement funds caught up. We travel and even save a little for the kids. All on one five-figure income. How?

Two words: Real Estate.

How We Turned It Around

Early Years: Cashflow Crushes Credit Crisis

In 2012, I bought a 4-plex that we “house hacked” (lived in one unit, rented out the other three). In the early years, it was the cashflow from our live-in 4-plex that dug us out of our huge financial pit.

Cashflow: “The monthly leftover rent income after you pay for all your expenses”.

The best example I can give was a particularly lucky stretch in the mid-2010s. For whatever reason, we had an eighteen-month period where almost nothing broke on our 120-year old house.

In the absence of maintenance expenses, the rents from the other three units covered:

The mortgage, utilities, and all other costs (so we lived for free in the 4th unit)… and

All of our barebones living expenses (!)

For one hyper-focused year and a half, we had not only free housing- but a free life. In that period, we were able to aim two full-time salaries at our six-figure student debt until it was gone.

“We could have kids now,” we thought. And so we did.

When the twins arrived, the cashflow from our 4-plex (and 2 other properties we added) replaced enough of my wife’s income for her to stay home with our young twins. To this day, the lifestyle freedom we enjoy stems from those early rentals.

But then all of a sudden… the cashflow completely dried up.

Pandemic Years: Appreciation Amplifies Affluence

Everything changed during the pandemic. From 2020-2025, costs went through the roof. Property taxes on the 4-plex soared from $3k/yr to $10k/yr. Handymen hourly rates jumped from $50/hr to $150/hr. We did three $20k bathroom remodels in three years. Insurance, labor, materials - it all basically tripled.

Our cash cow quickly became a cash vampire and all of a sudden we were losing money every year. Thankfully, the pandemic had blasted the price of the house into the stratosphere. Appreciation, we realized, had caught us up on retirement and all the goals we’d fallen behind on when my wife quit her job.

So after evaluating our rentals in light of high home prices, negative incomes, and Bill Perkins, we decided to sell.

What we didn’t understand (what the gurus don’t tell you) was the pound of flesh that we’d need to pay to leave the game. Freedom, it turns out, has an exorbitant price tag.

In my next post, I’ll tackle what happened when we finally signed the closing papers.