Die with Zero: Applied

My “hottest” post so far was a book review — Die with Zero.

Folks read the post. Many sent their takeaways. One guy even put it into a sermon.

All well and good. But it’s one thing to learn a few new ideas- it’s a whole different beast to let ideas change our beliefs- and our actions. Here are three ways I’ve attempted to “pull this book through my life.”

Change 1: I Sold All of My Real Estate

It’s not a great time to be selling houses. And trust me when I tell you that I did the math. Smart people rightly questioned me: “You’re going to give up a 3% interest rate?!” “Why are you selling in this market? Just wait a few years…” “Why would you hand over six figures in taxes to our insane federal government?!”

They weren’t wrong. Selling didn’t make sense last year- unless you’d read Die with Zero.

Statistically, my life is half done. I’m approaching 40 and my nine-year-olds are halfway out of the house. These are the good ol’ days.

Do I really want to spend this time fixing toilets and chasing tenants just to make more money for some hypothetical future date? When I was 25, I was penniless, but I had loads of time and energy for fixing old houses. In midlife that equation has completely flipped.

So while selling my rentals this year looked silly on the spreadsheet, in reality unloading them during this crazy/stressful/rich/impactful time was a no-brainer decision for my life. While I lost 20% of my net worth, I gained back 20% of my brain (more on real estate taxes and fees in a future post). What’s more, I scooped a heaping spoonful of time, energy and freedom onto the plate of these “peak” years.

And with this newfound freedom...

Change 2: We’re Moving(ish) to Europe

We’ll be living in Europe from January through July next year.

I could list a thousand reasons not to do this, financially and otherwise. But like Bill taught us, memories have dividends. Just like investing, when you do something might be more important than what you do.

As I picture 90-year-old Brett, sitting next to his gold-plated bedpan checking his Vanguard account, I wonder how much ‘wrinkly Brett’ would give to go back and take an epic potentially-life-changing adventure with his young family. Would 90-year old Brett tell me to go?

At its core, this trip is a bet. I am betting that I know exactly what he would say.

Change 3: What About the Kids?

Having read Die with Zero, I’m not interested in giving my kids a massive inheritance when they’re 70- especially at the expense of helping them when they actually need help. Instead, I want to push any financial help we give them into a time when they can actually use it. Or as Bill would put it, the age of the “peak utility of money”. Practically, the question I’m asking is: “How can I take a little of the pressure off of my kids when they’re 35?”

Recent changes to the tax code help. Starting this year, 529s are convertible into a Roth IRA. Next year, you will be able to set up a tax-free “Trump” account for your kids.

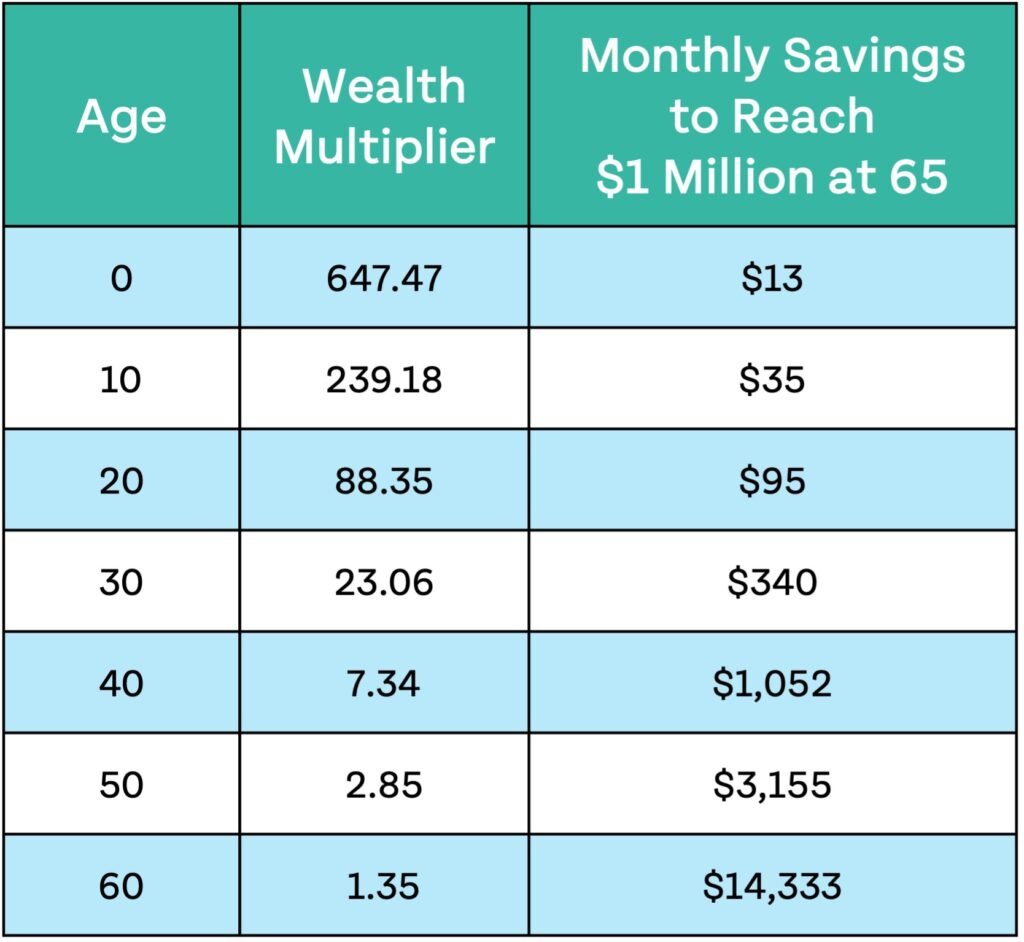

You don’t have to be a billionaire to help your kids massively- you just have to think ahead. At historic rates, every $1,000 you invest for a ten-year-old will equal about $240,000 when they retire. Or how about this one: A mere $1,545 invested for a newborn will grow to $1,000,000 by the time they retire. Note: Please stop and read that last sentence again- slowly.

My goal isn’t to set my kids up for “easy street”, but rather to take some of the heat off in mid-life when time, energy and money are most scarce - and most useful. I’ve started to do this with very small investments. My goal is to help with the things that are becoming increasingly difficult: college costs and saving for retirement. With those monkeys at least partially off their back, I wonder: how might that change their lives?

Conclusion

Money is a tool for your life. Not the other way around.

For me, applying Die with Zero hasn’t meant “burning through cash like a rockstar”. Rather, it’s simply been asking “Why am I so willing to trade heaps of scarce 38-year-old time and energy for a speculative 70-year-old Scrooge McDuck reality?”.

It’s been recognizing flaws in our human psychology - in my psychology - that push us to hoard and optimize for the spreadsheet over optimizing for life. In closing, these are just three of the changes I’ve made this last year. How about you?

What memory dividends have you invested in lately?

How have you pushed money from the low-utility times of life to high, for you or those around you?

What is your 90-year-old self begging you to do now?