13 Years (Part 3/Bonus): A Crash Course in Avoiding Real Estate Taxes

In the year leading up to selling our rentals, I researched every legal way to escape the exit-tax shakedown. Here are the main strategies I found for avoiding taxes, with a quick explanation of each each method, who it’s good for, and why we ultimately didn’t use it.

1. 1031 Exchange

What it is: This might be the ultimate loophole in the US tax code. The generous 1031 provision lets you sell one investment property and buy a larger one without paying any capital gains taxes on the sale. The taxes are deferred indefinitely.

Good for: People who want to double down on real estate with incredible efficiency.

Why we didn’t do it: We were trying to exit real estate, not get deeper into it. A 1031 exchange sends you deeper into the game.

2. 1031 → Future Primary Residence

What it is: You can’t directly 1031-exchange into a primary residence (a house you live in). But you can:

1031 into an investment property you might want to live in someday.

Rent the house out for two years.

Move into the house.

Live there long enough for your capital gains to disappear

Good for: People who want to upgrade their long-term home and are willing to follow through on the multi-year plan.

Why we didn’t do it: We almost did this one. The catch for us was that the replacement property would have needed to be expensive for the exchange to work with our numbers. If you know us, we value freedom and flexibility far more than some sort of ‘dream house’ that would tie us down financially (and geographically). So we passed.

3. Delaware Statutory Trust (DST)

What it is: A 1031 exchange into a passive real estate investment.

You 1031-exchange your sale proceeds into a DST (a pooled real-estate investment).

This keeps your gains tax-deferred while removing the landlord headache.

Good for: Older investors, hands-off real-estate investors, and people planning to stay in real estate but want it passive.

Why we didn’t do it: The projected returns (typically 3–7%) are lower than the stock-market and your money is locked up as long as the syndicator wants to hold onto it. As younger-ish investors, it made more sense to take the tax hit now for the chance of higher growth moving forward.

4. Syndication Roll-In (Tenant-in-Common)

What it is: Similar to DSTs, some real-estate syndicators let you roll your 1031 funds into their deal as a “TIC” investor- if your sale is big enough to justify the extra paperwork for them.

Good for: People with large gains who want passive real-estate exposure through a specific operator.

Why we didn’t do it: Open Door Capital was willing to take us, but after research, we weren’t comfortable tying a massive chunk of our net worth to a single syndicator (and things have gone pretty rough for syndicators lately).

5. Charitable Remainder Trust (CRT)

What it is: If you’re willing to agree to donate the proceeds to charity when you die, you can sell your property tax-free, invest the proceeds, and then take distributions from the investment for the rest of your life. Here’s how it works:

The (untaxed) money from the sale goes into a “charitable remainder trust” in which you can invest the proceeds however you see fit.

For the rest of your life, you are free to take monthly distributions from the trust.

Many ways to structure this (CRAT, CRUT, nimCRUT, etc. etc.)

Whatever remains at the end of your life goes to a charity of your choosing.

Good for: Older, charitably minded individuals—especially those without kids. There’s an age sweet-spot where it becomes very likely that you’ll outlive the IRS distribution tables and receive more in lifetime payouts than you would from selling outright. The net result could be that you walk away with more money and your ‘would-be-tax-money’ goes to a good cause rather than senators’ trust funds, the war machine, Somali terrorists(?), etc.

Why we didn’t do it: I was too young according to “the IRS table”.

Conclusion

These preceding strategies can be powerful when matched to the right stage of life and long-term plan. In our case, none of them aligned with our goals, risk tolerance, or desire to simplify and be free. So we paid the six-figure tax bill, freed up our time and headspace, and moved on.

If you’re facing a big sale, exploring these options might save you tens or hundreds of thousands. Just know that every path comes with tradeoffs, timelines, and fine print.

13 Years (Part 2): Leaving Real Estate and Reflecting

In the real estate lounge, you can leave whenever you want. But to get to the door, you need to get through a gauntlet of muscly-armed bouncers will all demand a gruesome payment on the way out.

This is something that the online gurus didn’t tell me.

For any would-be real estate investors, let me give you a realistic taste of what you can expect when selling an appreciated investment property.

This Year: Painful Profits

The “pound of flesh” I paid to sell my houses:

I gave $85,000 to Uncle Sam

I gave $55,000 to the State of Minnesota

I gave $40,000 to the Contractor

I gave $20,000 for my Realtors

I gave $30,000 for the Buyer’s Realtors

I gave $30,000 in depreciation recapture taxes

I gave thousands more to the county, the closer, and on and on.

Selling my houses left me with a chunk of cash… and chopped over $200,000 from our net worth- all at the same time.

My Financial Aron Ralston Moment

At times, this year felt like our financial "Aron Ralston" moment (the Utah hiker who famously cut off his own arm to gain his freedom and his life.)

I can’t tell you how hard it was to give years’ worth of my salary to dubious governmental causes. But simply put, that was the price of freedom- and the only thing worse than paying the money… was not paying the money (and staying stuck).

We’re glad we sold. But that’s not the million dollar question. The most important question is this:

Would I do it all over again if I was 25?

Reflecting On Why Real Estate Worked

In short, yes. I would do it all over again. In fact, I would have gone even bigger.

Despite my exit-cost-whining, real estate worked for us. With sustained effort, our rentals turned us from a financial train wreck into a Shinkahnsen bullet train.

“Sure” you say, “but the stock market works too - and without the house calls”.

Believe me, I know. I’m a stock man myself now.

But for young folks, I’m still giving the edge to real estate over stocks for two reasons:

Life Skills

Leverage

Skills

I quickly learned construction, plumbing, electric, business and marketing, law, tax code, hiring, firing, and rapid-problem solving. I know of no better business, nay, life education than managing real estate.

From the fixed-up foreclosure we now live in to the leases I wrote last week to rent out our house while in Europe- so much of what I do and who I am wouldn’t be possible without having attended the school of owning properties.

Leverage

Ok, but why did real estate work financially for us? Why was it better than a Vanguard fund? The answer is simple: leverage. In 2012, they let a broke 25-year-old kid take the reins of a quarter-million-dollar apartment building - for $9,000. You won’t find a deal like this anywhere else in the world of investing.

With a small FHA down payment on that first 4-plex, I kicked off years of significant cashflow and appreciation on valuable assets.

Conclusion

These days, financial success hinges on a few things:

Hard work

Luck

Understanding the hyper-capitalistic system in which we live

In the age of declining dollars, owning assets is the only game in town.

Real estate is the only asset class that teaches you something and lets you own humongous assets early in life with fixed-rate debt and relatively little money.

Then vs Now

And I know- current times are tough in real estate. It would be very hard to replicate what we did in 2012 at this exact moment in time. My hunch is that it won’t be this difficult forever.

If and when things change for the better, the key question for you is- would you dive in?

Many of you don’t need the hassle. But just maybe you’re reading this now and wouldn’t mind riding the bull for a few years if it meant landing a new place in your finances- and maybe your life.

Real estate completely changed our trajectory. Maybe it could change yours too.

13 Years (Part 1): Turning Our Life Around with Real Estate Investing

A Retrospective

Real estate changed our life. To understand how, I think of what a call to Dave Ramsey would have been like back in 2012.

Back up a step. On Dave’s show, there are three kinds of callers:

Humble-braggers: "Hey Dave, I make $400k as an oil rig analyst and the cash under my mattress is starting to hurt my back."

Weird-nichers: "My aunt left me a $2M dolphin but I can’t sell with the Iowa Dolphin tax."

Train-wrecks: "I’ve got 6 masters’ degrees in underwater basket weaving and just noticed I’m $700k in debt. Is that bad?"

Back in 2012 we were heading for number 3.

Our Shaky Financial Start

Here’s how our call-in would have sounded:

Dave: “Hi, 2012 Brett. What’s your story?”

2012 Brett: "Hi Dave, I've got $50k in student loans and I just married a girl with $60k of her own.

Dave: “Wow, that’s $170,000 in 2025 inflation-adjusted dollars.”

2012 Brett: “Uh… ok. Anyways, I make $50k a year and have zero savings. Oh yeah, one more thing - we're about to buy a house, have three kids… and my wife won't be working for the next decade.What baby step am I on?"

We weren't a “railway carnage” case yet- but we were speeding down the tracks. Thankfully, we found a way to avoid the massacre.

A decade later, our debt is gone. Retirement funds caught up. We travel and even save a little for the kids. All on one five-figure income. How?

Two words: Real Estate.

How We Turned It Around

Early Years: Cashflow Crushes Credit Crisis

In 2012, I bought a 4-plex that we “house hacked” (lived in one unit, rented out the other three). In the early years, it was the cashflow from our live-in 4-plex that dug us out of our huge financial pit.

Cashflow: “The monthly leftover rent income after you pay for all your expenses”.

The best example I can give was a particularly lucky stretch in the mid-2010s. For whatever reason, we had an eighteen-month period where almost nothing broke on our 120-year old house.

In the absence of maintenance expenses, the rents from the other three units covered:

The mortgage, utilities, and all other costs (so we lived for free in the 4th unit)… and

All of our barebones living expenses (!)

For one hyper-focused year and a half, we had not only free housing- but a free life. In that period, we were able to aim two full-time salaries at our six-figure student debt until it was gone.

“We could have kids now,” we thought. And so we did.

When the twins arrived, the cashflow from our 4-plex (and 2 other properties we added) replaced enough of my wife’s income for her to stay home with our young twins. To this day, the lifestyle freedom we enjoy stems from those early rentals.

But then all of a sudden… the cashflow completely dried up.

Pandemic Years: Appreciation Amplifies Affluence

Everything changed during the pandemic. From 2020-2025, costs went through the roof. Property taxes on the 4-plex soared from $3k/yr to $10k/yr. Handymen hourly rates jumped from $50/hr to $150/hr. We did three $20k bathroom remodels in three years. Insurance, labor, materials - it all basically tripled.

Our cash cow quickly became a cash vampire and all of a sudden we were losing money every year. Thankfully, the pandemic had blasted the price of the house into the stratosphere. Appreciation, we realized, had caught us up on retirement and all the goals we’d fallen behind on when my wife quit her job.

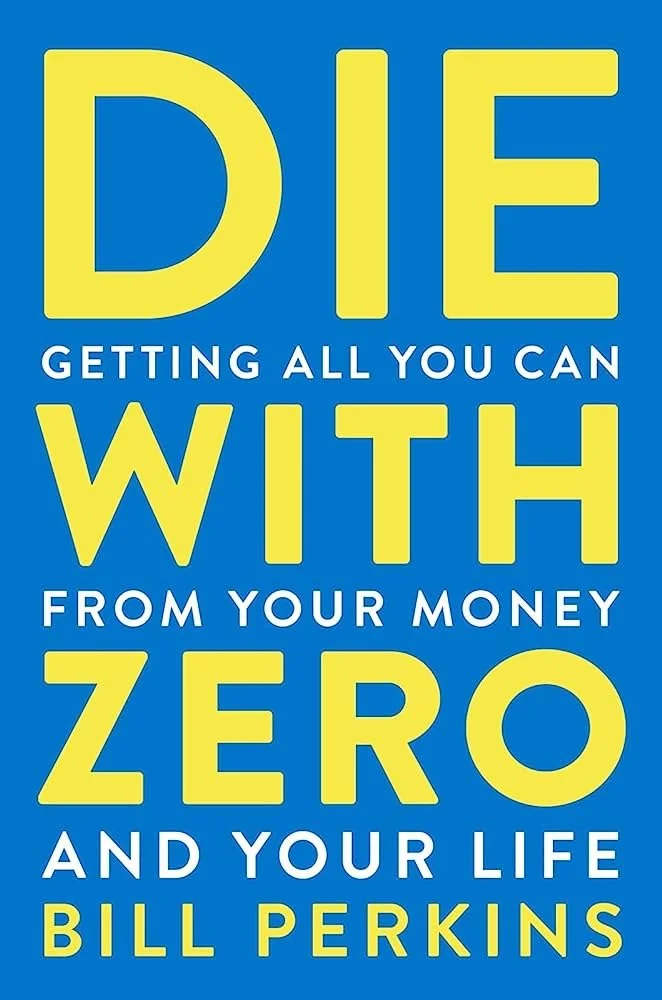

So after evaluating our rentals in light of high home prices, negative incomes, and Bill Perkins, we decided to sell.

What we didn’t understand (what the gurus don’t tell you) was the pound of flesh that we’d need to pay to leave the game. Freedom, it turns out, has an exorbitant price tag.

In my next post, I’ll tackle what happened when we finally signed the closing papers.

Die with Zero: Applied

My “hottest” post so far was a book review — Die with Zero.

Folks read the post. Many sent their takeaways. One guy even put it into a sermon.

All well and good. But it’s one thing to learn a few new ideas- it’s a whole different beast to let ideas change our beliefs- and our actions. Here are three ways I’ve attempted to “pull this book through my life.”

Change 1: I Sold All of My Real Estate

It’s not a great time to be selling houses. And trust me when I tell you that I did the math. Smart people rightly questioned me: “You’re going to give up a 3% interest rate?!” “Why are you selling in this market? Just wait a few years…” “Why would you hand over six figures in taxes to our insane federal government?!”

They weren’t wrong. Selling didn’t make sense last year- unless you’d read Die with Zero.

Statistically, my life is half done. I’m approaching 40 and my nine-year-olds are halfway out of the house. These are the good ol’ days.

Do I really want to spend this time fixing toilets and chasing tenants just to make more money for some hypothetical future date? When I was 25, I was penniless, but I had loads of time and energy for fixing old houses. In midlife that equation has completely flipped.

So while selling my rentals this year looked silly on the spreadsheet, in reality unloading them during this crazy/stressful/rich/impactful time was a no-brainer decision for my life. While I lost 20% of my net worth, I gained back 20% of my brain (more on real estate taxes and fees in a future post). What’s more, I scooped a heaping spoonful of time, energy and freedom onto the plate of these “peak” years.

And with this newfound freedom...

Change 2: We’re Moving(ish) to Europe

We’ll be living in Europe from January through July next year.

I could list a thousand reasons not to do this, financially and otherwise. But like Bill taught us, memories have dividends. Just like investing, when you do something might be more important than what you do.

As I picture 90-year-old Brett, sitting next to his gold-plated bedpan checking his Vanguard account, I wonder how much ‘wrinkly Brett’ would give to go back and take an epic potentially-life-changing adventure with his young family. Would 90-year old Brett tell me to go?

At its core, this trip is a bet. I am betting that I know exactly what he would say.

Change 3: What About the Kids?

Having read Die with Zero, I’m not interested in giving my kids a massive inheritance when they’re 70- especially at the expense of helping them when they actually need help. Instead, I want to push any financial help we give them into a time when they can actually use it. Or as Bill would put it, the age of the “peak utility of money”. Practically, the question I’m asking is: “How can I take a little of the pressure off of my kids when they’re 35?”

Recent changes to the tax code help. Starting this year, 529s are convertible into a Roth IRA. Next year, you will be able to set up a tax-free “Trump” account for your kids.

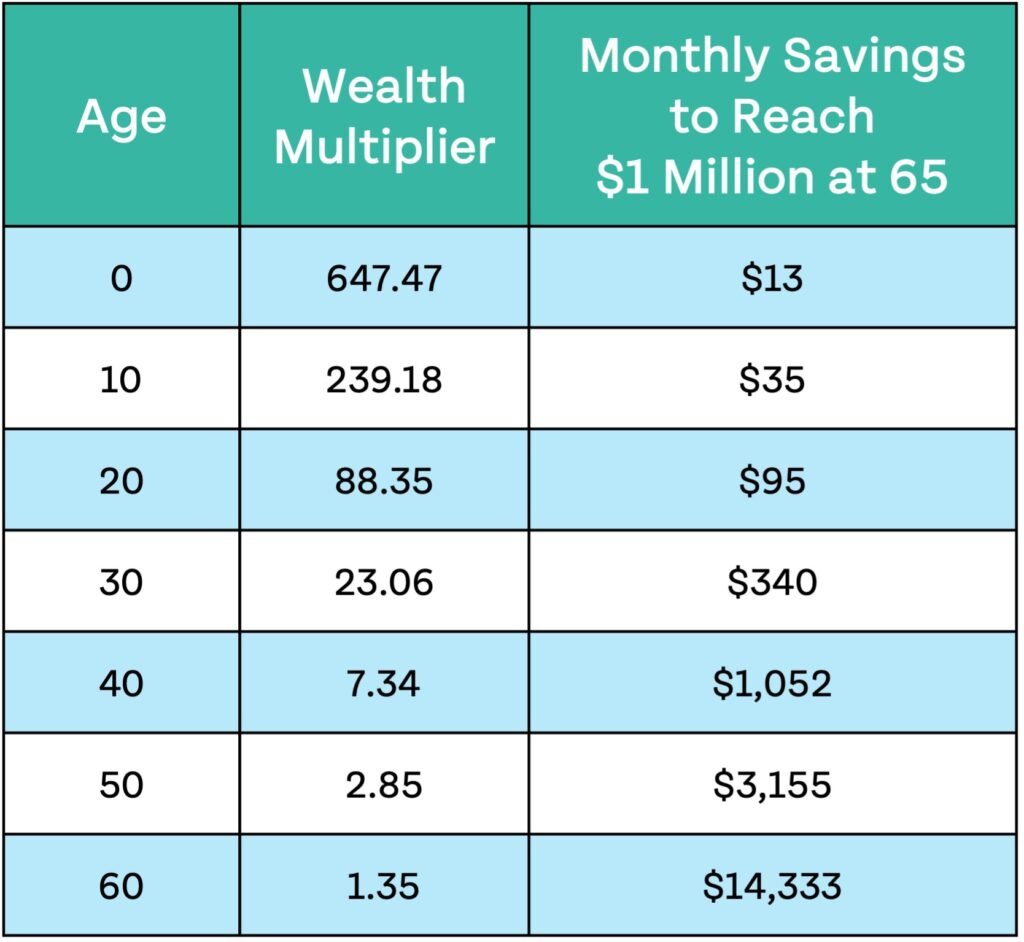

You don’t have to be a billionaire to help your kids massively- you just have to think ahead. At historic rates, every $1,000 you invest for a ten-year-old will equal about $240,000 when they retire. Or how about this one: A mere $1,545 invested for a newborn will grow to $1,000,000 by the time they retire. Note: Please stop and read that last sentence again- slowly.

My goal isn’t to set my kids up for “easy street”, but rather to take some of the heat off in mid-life when time, energy and money are most scarce - and most useful. I’ve started to do this with very small investments. My goal is to help with the things that are becoming increasingly difficult: college costs and saving for retirement. With those monkeys at least partially off their back, I wonder: how might that change their lives?

Conclusion

Money is a tool for your life. Not the other way around.

For me, applying Die with Zero hasn’t meant “burning through cash like a rockstar”. Rather, it’s simply been asking “Why am I so willing to trade heaps of scarce 38-year-old time and energy for a speculative 70-year-old Scrooge McDuck reality?”.

It’s been recognizing flaws in our human psychology - in my psychology - that push us to hoard and optimize for the spreadsheet over optimizing for life. In closing, these are just three of the changes I’ve made this last year. How about you?

What memory dividends have you invested in lately?

How have you pushed money from the low-utility times of life to high, for you or those around you?

What is your 90-year-old self begging you to do now?

Favorite Things: August ‘25

What I've been Doing

Reinventing my life. Ha! kidding… sort of. Outside of the normal stuff I’ve been:

Quitting Real Estate

In the spring, I sold the first rental property I ever bought. Today, I signed the closing docs for the sale of my last rental property. Getting out of the game has absorbed much of my time, thought, and energy- and warrants a slew of posts. From reasons why to tax strategies, from identity shifts to what comes next, I look forward to writing more—without the distraction of fixing toilets or herding tenants.

Going Hard on Points

After “80/20’ing” the other side hustles out of my life, I decided to go all-in on credit card bonuses. So far this year, I’ve earned roughly 1.24 million points across 14 credit cards. This includes points from Hyatt, IHG, Capital One, Chase, American Airlines, United, and more. (Hat tip to these two guys for expanding my idea of what is possible.)

Launching a New Product at Work

After a company re-org in ’23/’24, my first assignment with my new team was to PM the launch of the most significant Salesforce tool our department has ever implemented. We launched last weekend!

Planning Our Biggest Trip Yet

With a 15-years-at-the-company sabbatical coming this spring, we’re planning our most ambitious European adventure ever (on a shoestring budget, of course).

What I've been Reading

Fate of the Day by Rick Atkinson

Atkinson’s storytelling doesn’t just give the full-color context around the American Revolution. His true genius lies in making the worn familiar names- Washington, Franklin, Lafayette, (Howe, Cornwallis, and George)- come alive. More, he makes you realize how little you knew about these most famous of men and their real stories.

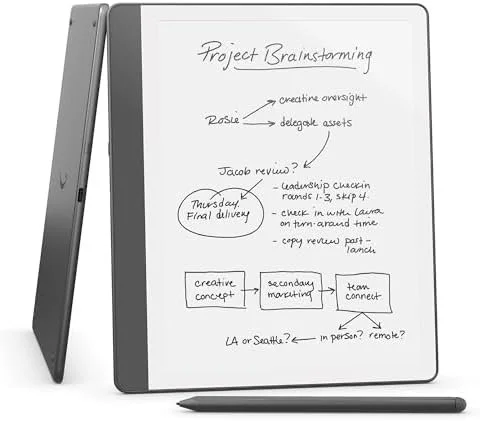

I couldn’t put the first book in the series (The British are Coming) down. When I heard number two in the trilogy dropped, I downloaded it to my Kindle Scribe and haven’t looked up since. (Amazon)

Habits of the Household by Justin Whitmel Earley

The most fundamental and profound thing about your life (and your family’s) isn’t a trip you take or a great conversation you have. It’s what you do every day. This book is a beautifully written (and approachable-for-everyday-sinners) look at simple daily practices that can anchor your home around spiritual touchpoints and rhythms of the gospel. With a later school start time this year, we will be tinkering with a number of ideas from this excellent title. (Amazon)

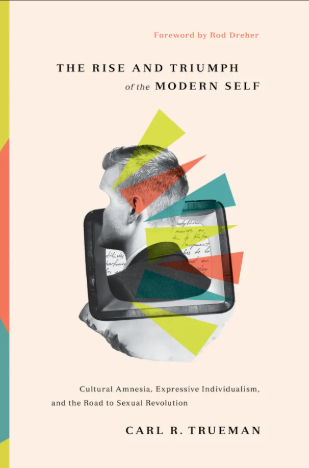

The Rise and Triumph of the Modern Self by Carl Trueman

In The Rise and Triumph of the Modern Self, Carl Trueman tackles the fundamental shift driving so much of our quickly-changing culture: how we all understand our “self”.

Take this statement: “I’m a woman trapped in a man’s body”. Whether you empathize with or are repulsed by this statement, Trueman’s point is simple: that this sentence would have been completely meaningless in every culture in human history- other than ours. The fact that this idea makes sense today in the West is just one downstream indicator of the massive shift in how we now define identity.

Tracing thinkers from Rousseau to Nietzsche, Trueman follows how the self moved from being rooted in objective, external reality to being defined by inner feelings and expression. If you want to understand and engage with the wild west of ideas that make up our current cultural imagination, this book is essential for getting you to the root of how our collective worldview is changing. (Amazon)

Provence (Glory) - Assouline

Bougie travel book designed to transport you. Provence nails it — gorgeous photography and text that lets me “flip” myself into lavender, sun, and sea at the end of a long Minnesota day. (Amazon)

What I've been Watching

Drops of God (Apple TV)

A heart-tugging storyline driven by sommelier family dynamics, elevated by stunning settings in Southern France and Tokyo.

La Casa de Papel (Money Heist, Netflix)

The first seasons are riveting, creative, and tense. By the last season, though, you’ll wonder who kidnapped the original writers- it definitely goes downhill by the end.

A Complete Unknown (2024 Dylan Biopic)

For the big Bob movie, I actually made it to a theater. What I loved:

Time & Place: 1960s Greenwich Village and all the tumult of the 60s comes into full color - and so too, the…

Songs: It’s one thing to hear Blowin’ in the Wind in a college classroom (like I first heard it). It’s another to see a young Dylan working out the chords in his village apartment… and then singing it weeks later to a packed hall in the wake of integration and its upheaval.

Chalamet: I disliked his early work (and may have dismissed him as the bellwether of an androgynous shift of the western male archetype). His role in Dune softened me. The acting and singing(!) in Complete Unknown (along with his visit to Hibbing High and fluency in French) have completely won me over. The kid’s great.

Youtube Music Universe

Here were some of my of-late award winners. Crank up your headphones:

Best National Anthem Award (<60 lbs Division): Malea Emma

Best National Anthem Award (Full-Grown-Man Division): Chris Stapleton

Smooth Norwegian Award: Dancing in the Dark - Jorgen Dahl Moe

Ultimate ‘Made-for-Youtube’ Award: Can’t Help Falling in Love - 21 Pilots

Most 70s Cover Ever Award: Have You Ever Seen the Rain - Jesse Welles and Matt Quinn

Purest Syringe of 90’s Glory Award : First TV Performance of “Name” - Goo Goo Dolls (song at 3:15)

90’s Crazy-Talent Runner Up: Hook - Blues Traveler

What I've been Improving

My French

I’ve slowly approached the borderline between A1 and A2 on the CEFR scale. Progress is snail-like but satisfying. My latest realizations:

The unconscious aspect of learning a language: We spend hours on conjugation tables and struggle to understand word order… but that’s not remotely how we learned our first language. In fact, no one explained the rules of our first language at all. but we somehow learned it to fluency. This should make us language-learners pause.

There are many methods to learning a language. Some are better than others.

Method I’ve been leaning into: Comprehensible Input, where you’re listening to material that’s at or just above your current level of understanding. Practically for me (A1 French Learner) that’s been a simple Youtube channel from the incredible Alice Ayel.

What I've been Using

Kindle Scribe

I snagged one for >50% off during Prime Days. The purchase initially triggered the “money waste alert” in my brain - until it arrived in the mail.

This device is all the books in the world in a highlightable, “mark-up-able” format with a super-thin, light profile. It also contains infinite notebooks that you can OCR and sync with one touch. The Scribe absolutely crushes past Kindles and is quickly becoming my default for both reading and writing. Pair with Readwise and Obsidian for synergistic second-brain superpower. (Amazon)

ChatGPT

Love the coming AI-pocalypse or hate it, you need to know how to use this tool. For an example: let’s say hypothetically you’re selling a rental property and want to figure out your taxes.

1990: [Flipping through Dewey-Decimal cards, searching for tax law]

2015: [Googling “capital gains rental property Minnesota”]

2025: “Here are my numbers, ChatGPT”

Result: Instant tax calculation, personalized explanation, and tailored strategy for your exact situation

Now do this ^ for everything in your life. It ain’t perfect (yet), but this is not a technology you want to pass you by.

Superhuman

The sleek email app that cuts my inbox-clearing time by over half. Yes, it’s pricey, but if you hate email as much as I do, it’s worth every penny. (Superhuman)

Where I've been Traveling

Bordeaux & the French Atlantic Coast

Following a work trip, I was able to sneak away to the world capital of wine. I loved Île de Ré, La Rochelle, Saint-Émilion, and Bordeaux itself. But if I’m honest (and a little snobby)… I’d take dry mountainous Provence over flat, wet Bordeaux any day of the week.

Northern Spain

From the lush Costa Verde and the Picos de Europa on through to Basque country, the sheer eye-candy of this region surprised and thrilled me. Add charming, untouristed villages (and churros con chocolate for breakfast), and you’ve got one of the most incredible, underrated corners of Europe.

North Shore of Minnesota

One of my favorite places on earth is just a few hours from home. You still can’t beat Superior’s perfect blend of pine, rock, and water.

Ok, that’s the snapshot. In summary, this last year has been all about making more room for what matters. Thanks for reading and let me know if there's anything above you want me to expand on in future posts. I hope all is well on the other end :)